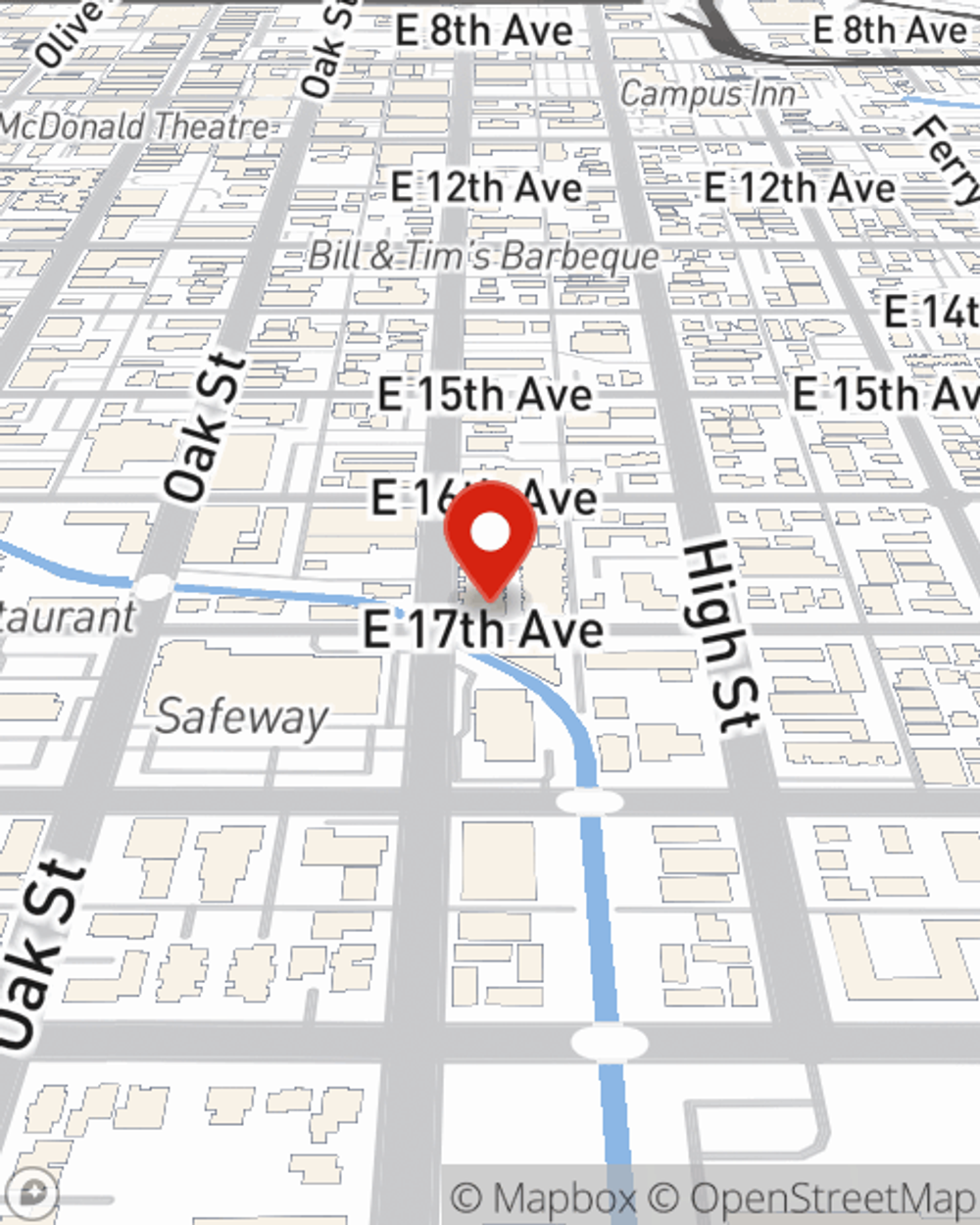

Renters Insurance in and around Eugene

Your renters insurance search is over, Eugene

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Eugene, Oregon

- Springfield, Oregon

- Coburg, Oregon

- Veneta, Oregon

- Salem, Oregon

- Portland, Oregon

- Bend, Oregon

- Junction City, OR

- Wilsonville, Oregon

- Redmond, Oregon

- Creswell, Oregon

- Cottage Grove, OR

- Keizer, Oregon

- Albany, Oregon

- Tigard, Oregon

- Harrisburg, Oregon

- Corvallis, Oregon

- Newport, Oregon

- Lincoln City, Oregon

- Beaverton, OR

- Hillsboro, OR

- Gresham, OR

- Medford, OR

- Grants Pass, OR

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or property, renters insurance can be the right next step to protect your personal property, including your books, golf clubs, boots, guitar, and more.

Your renters insurance search is over, Eugene

Renting a home? Insure what you own.

There's No Place Like Home

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Mayra Quaas can help you develop a policy for when the unpredictable, like a fire or a water leak, affects your personal belongings.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Eugene. Call or email agent Mayra Quaas's office to talk about a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Mayra at (541) 654-4780 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Mayra Quaas

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.